At the end of 2022, subscription wine seller Winc filed for bankruptcy. The company went public in late 2021, launching its IPO before it reached profitability. Unfortunately, the service never made it into the black. Winc’s bankruptcy filings reveal that revenues declined over the past year, and the company could not pay its bills — including over $700,000 it owes to Meta (Facebook) for advertising.

Bankruptcy proceedings may bring the full truth of Winc’s collapse to light. But looking at the company’s declining revenue and the fact that its biggest creditor is an advertising platform, it’s possible the company’s customer acquisition cost (CAC) payback period exceeded what its subscription model could support.

This metric is a key indicator of whether you have a successful subscription pricing model or whether you’ll end up burning cash like Winc. Read on to learn the CAC payback period formula so you can calculate and interpret this data point.

The CAC payback period is the amount of time it takes you to recoup the cost of acquiring each new customer. Merchants need to know their CAC payback period to avoid losing money with each new subscriber they enroll.

As the name suggests, this metric measures your profits in relation to your CAC. Ecommerce subscription businesses spend around $65 on average to win over a new customer — though your CAC may be higher or lower depending on the market you’re selling in and your target demographic. We’ll show you how to calculate this number as part of our CAC payback period calculation walkthrough.

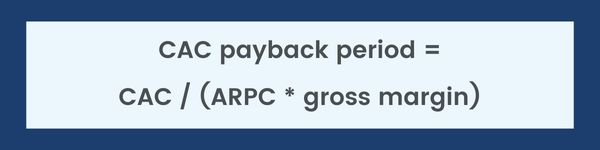

The CAC payback period formula divides your CAC by your monthly profits to determine how long you have to keep a subscriber before they repay the marketing costs spent to win them over. It’s not the most complex subscription formula, but we recommend following this multi-step process if you want an accurate result.

You’ll recognize many of these calculations if you’ve already followed our LTV:CAC ratio tutorial. (If you haven’t, record the numbers you find for steps one through three below and then do that calculation next!)

.jpg)

The formula for CAC returns the amount you spend to acquire each customer you have. Make sure you sum your marketing spend and new customers across from the same time period.

Your sales and marketing costs shouldn’t include any campaigns that aren’t related to acquisition. For example, the money you put toward upselling or cross-selling existing customers isn’t a part of your CAC.

.jpg)

You’ll need to know how much you earn per customer to determine how long it takes to recoup your CAC from each. It’s easy to find your ARPC — just divide your monthly recurring revenue (MRR) by the number of active subscribers from that month.

This formula calculates monthly ARPC and assumes a monthly subscription; if you offer variable subscription periods, the calculation is a bit more complex. You may need to look at your recurring revenue over a longer period (such as a quarter instead of a month), so the calculation includes every active subscriber’s purchases. Substitute your recurring revenue over your calculation period for MRR.

If you’re working with variable subscription periods, convert your final ARPC to match your most common subscription period. For example, say a few of your subscribers buy every other week, the majority buy once a month and some buy once per quarter. You’d need to use your quarterly recurring revenue to cover all your income. Then you’d divide the resulting number by three (since there are three months in one quarter).

Revenues are always higher than profits, so using the former to determine your CAC payback period will give you an artificially low number. Your gross margin tells you which percentage of each purchase can go toward your marketing expenses.

Use the formula above to determine how much you profit from each subscription purchase. Here’s how to find your Cost of Goods Sold (COGS) — the metric you’ll need to determine gross margin — if you don’t know it already.

The CAC payback period formula combines the numbers from steps one through three to determine how many subscription periods you’ll need to recover marketing costs from each new subscriber. First, you’ll multiply gross margin by ARPC to determine gross profits per customer per subscription period. Then, divide your CAC by that result to determine how many subscription billing periods it takes for those profits to pay off your upfront marketing and sales costs.

While the formula above will help you evaluate your subscription business model’s health, it will not give you to-the-penny accuracy. For one, it doesn’t account for customer churn. If a customer cancels their subscription before their CAC payback period ends, you won’t recoup your full marketing costs from them. You’ll have to recover that money from another subscriber instead.

Our ARPC calculation also didn’t use net MRR, which would include losses to churn or downgrades and gains from upsells and cross-sells. A simplified version of MRR is exact enough to get a helpful answer from this formula, so we opted for the time-saving measure.

Subscription merchants should optimize for a shorter payback period and high customer retention rates. You want your average subscriber to stick around for longer than it takes them to pay back the cost of acquisition. Every subscription will have some customers who cancel before the break-even point. But if you have too many churned subscribers, your losses on acquisition will seriously cut into your profits.

Benchmarking the CAC payback period is difficult because merchants’ gross margin percentages vary widely depending on the type of products they sell. But now that you’ve calculated your current CAC payback period, you can use the figure as an internal benchmark and start working to improve on it.

Decreasing your CAC payback period isn’t as simple as decreasing your CAC: If cutting marketing costs compromises the quality of your leads, you’ll win fewer customers and have a higher churn rate. Both consequences can increase your CAC payback period. Here are two methods we recommend for optimizing your CAC payback period the smart way.

The more profit you make per customer, the shorter your CAC payback period will be. If you can increase a customer’s average order value (AOV) to $20 from $15, and your gross margin is 80%, that extra four dollars each month can go toward paying back your CAC.

Ecommerce merchants can use subscription pricing strategies to increase their buyers’ AOV:

Small AOV increases can add up if they’re spread across enough customers, so don’t be shy about offering consumers the chance to receive more value by committing to a higher price point.

Revamp your marketing strategy to target the consumers who are more likely to sign up and stick around with your subscription service. More subscribers per dollar spent means a lower CAC; higher retention means you won’t lose as much to newcomers who cancel before earning back the money you spent marketing to them.

Most ecommerce subscription platforms (including sticky.io) have tools to help you determine which marketing channels and campaigns have the highest conversion rates. Merchants who offer various subscription plans may also want to see where their biggest spenders (in terms of AOV and CLTV) come from. It’s worth paying more for a subscriber who spends significantly more with your company.

Experiment with decreasing your spend or pressing pause on the channels that don’t bring in as much traffic and/or have low conversion rates. But keep a close eye on your CAC, since fewer conversions can increase this metric.

CAC payback period is an essential subscription metric — but it isn’t the only key indicator of whether you have a successful business model. Retention rate and LTV:CAC ratio can help you contextualize your CAC payback period and determine the health of your business.

Keep on top of these essential data points with a subscription management CRM that tracks and calculates foundational subscription metrics for you. sticky.io has built-in customer dashboards that generate reports on your:

We visualize your data, so it’s easy to track your performance at a glance. You can watch how adjustments to your marketing efforts affect your CAC in real-time.